The Key Changes in the VAT Treatment of Fixed Establishments from 2024

The decision regarding the Value Added Tax (VAT) treatment for fixed establishments has been revised as of January 1, 2024, following a ruling by the Court of Justice. Below, we explain the implications of these changes for you.

Change in territorial limitation of VAT group

The amendment addresses a territorial limitation of the VAT group. This means that a VAT group is no longer possible in cross-border cases. The supplies between a head office and a fixed establishment are thus subject to VAT if either the head office or the fixed establishment in another Member State belongs to a VAT group with another company.

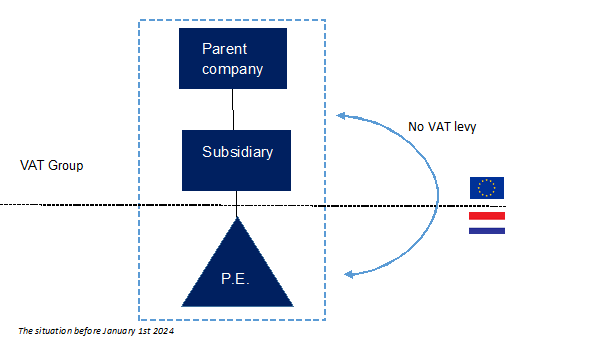

Situation before the amendment of the fixed establishment decision

Prior to the amendment in the decision concerning fixed establishments, the principle was that, in general, no supplies or services occurred between the head office and the fixed establishment because they were collectively considered as one entrepreneur for VAT purposes. A foreign-based entrepreneur could become part of a Dutch VAT group through a fixed establishment in the Netherlands. This interpretation stemmed from a ruling by the Supreme Court on June 14, 2002, which determined that the Dutch VAT group encompassed the entire legal entity. Since a fixed establishment and the head office were viewed as one entrepreneur, both the Dutch fixed establishment and the foreign head office were part of the VAT group in the Netherlands.

Reason for the amendment of the fixed establishment decision

The reason for amending the decision concerning fixed establishments was a ruling by the Court of Justice in the cases of Skandia (Case C-7/13) and Danske Bank (Case C-812/19), which established that supplies between branches of the same legal entity are subject to VAT when at least one of the branches is part of a VAT group. This implies that both when the head office is part of a foreign VAT group and when the fixed establishment is part of a VAT group in the Netherlands, the VAT group is considered a separate taxable entity, not linked to a fixed establishment or head office.

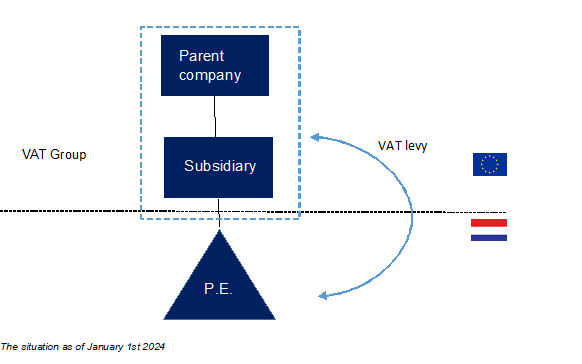

Situation after the amendment of the fixed establishment decision

Following the aforementioned rulings, the policy has now been revised, effective January 1, 2024. Consequently, an exception is made to the principle that no VAT is levied on supplies between the head office and a fixed establishment. If the head office or the fixed establishment is part of a VAT group, supplies between the VAT group and a foreign head office/fixed establishment are subject to VAT. This renders the Supreme Court ruling on June 14, 2002, irrelevant for assessing the scope of a VAT group in the Netherlands.

What does the amendment mean for you?

The amendment to the decision concerning fixed establishments has implications for every entrepreneur who has both a fixed establishment and a VAT group within the EU. However, if you are an entrepreneur with limited VAT deduction rights, the amendment may have a greater impact. As supplies between the head office and the fixed establishment are now visible for VAT purposes, this may have financial consequences.

It is important to assess the extent of fixed establishments and VAT group, including determining the extent of cross-border transactions. Additionally, it is crucial to evaluate the applicability of the right to VAT deduction. The amendment to the decision may not always be detrimental. In the case of a Dutch entrepreneur conducting many transactions in a foreign fixed establishment, the right to VAT deduction may actually increase.

More information?

Would you like to know more about the VAT treatment of permanent establishments and VAT groups and how it affects your business? Or do you have any other inquiries related to VAT? Our colleagues from the VAT Division can advise and assist you. Call Anne Kin, VAT specialist, at +31 (0)13 591 51 25 or send Anne an e-mail.